Before we get into the details of the November housing market data released this morning by the Canadian Real Estate Association (CREA), big positive news for housing occurred yesterday. The US Federal Reserve gave its clearest signal yet that its historic policy tightening campaign is over by projecting more aggressive interest-rate cuts in 2024. This ignited one of the biggest post-meeting rallies in bonds and stocks in recent memory. Global shares spiked higher. Short-term Treasuries posted their best day since March, while world currencies surged against the US dollar and corporate bonds rallied. Canadian markets followed suit. If anything, Canada is far more interest-sensitive than the US, and our economy is far weaker.

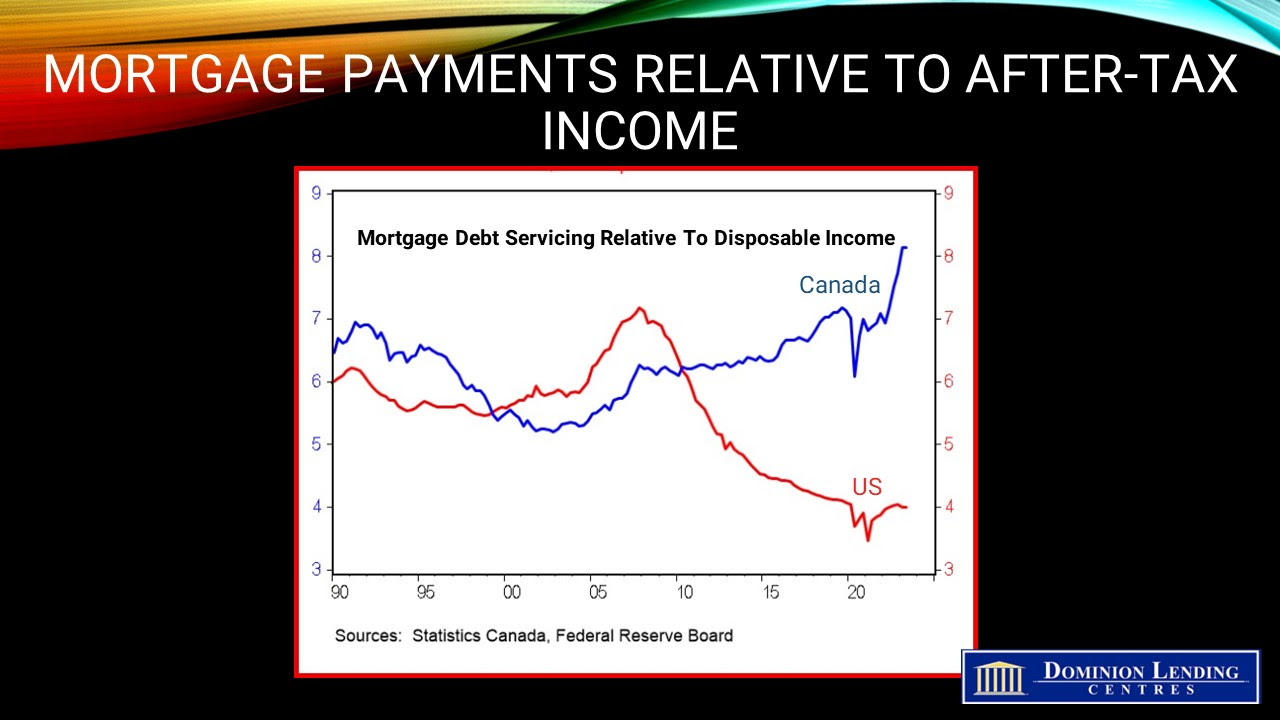

As the charts below show, monthly mortgage payments relative to after-tax income are far higher in Canada than in the US, even more so given the tax deductibility of mortgage interest and property taxes south of the border. The US economy grew by a whopping 5.2% in the third quarter compared to a decline of 1.1% in Canada. Therefore, the Bank of Canada will likely cut interest rates sooner and more aggressively than in the US, improving housing affordability.

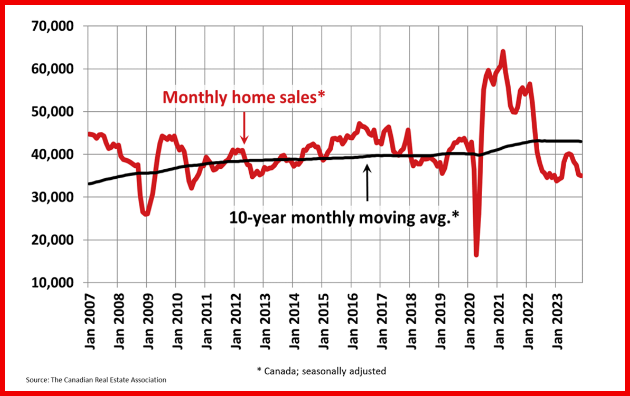

The CREA data for November showed a bottoming housing market. Home sales recorded over Canadian MLS® Systems edged down by 0.9% from October to November 2023, the smallest decline since July.

New Listings

Sellers move to the sidelines as well. The number of newly listed homes fell 1.8% month-over-month in November. This followed a 2.2% decline in October.

With new listings down by more than sales in November, the national sales-to-new listings ratio tightened slightly to 49.8% compared to 49.4% in October. It was the first time this measure has increased since April. The long-term average for the national sales-to-new listings ratio is 55.1%.

There were 4.2 months of inventory nationally at the end of November 2023, up only slightly from 4.1 months at the end of October. As such, this measure also looks to be stabilizing and is still almost a full month below its long-term average of nearly five months of inventory.

The second chart below shows that we are definitely in a buyers’ market.

Home Prices

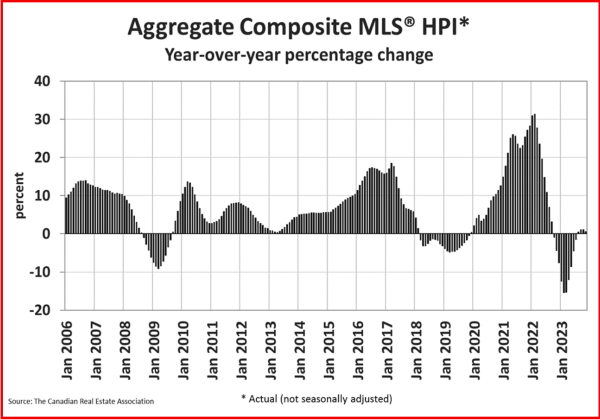

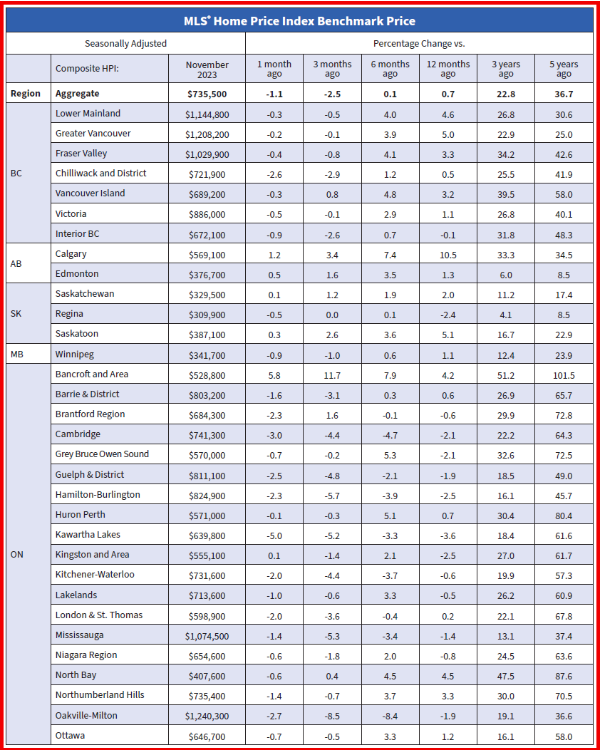

The Aggregate Composite MLS® Home Price Index (HPI) declined by 1.1% month-over-month in November 2023, reflecting softer market conditions since the end of the summer. Prices often react with a slight lag, so it will be interesting to see if month-over-month declines get smaller or stop getting larger in December in response to a stabilizing demand-supply balance.

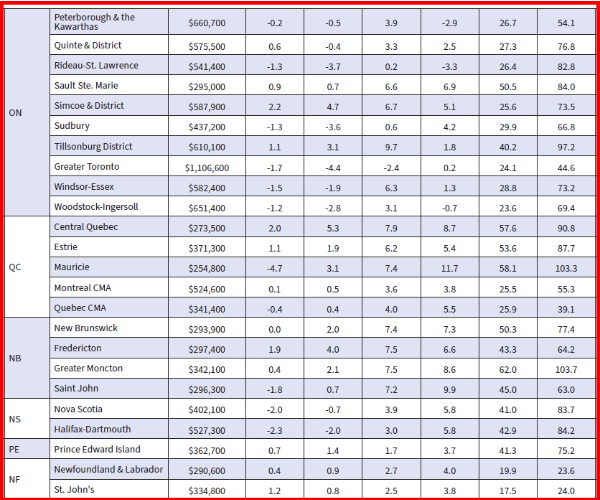

While price declines remain mainly an Ontario phenomenon, home prices are now softening in the Fraser Valley, Winnipeg, and Halifax. Elsewhere in Canada, prices are mostly holding firm or, in some cases (Alberta, Saskatchewan, New Brunswick, Price Edward Island, Newfoundland and Labrador), continuing to climb. The Aggregate Composite MLS® HPI was up 0.6% on a year-over-year basis.

Bottom Line

The Bank of Canada policymakers will meet again on January 24th. While it will likely be several months before the Bank begins to cut the policy rate, market-driven interest rates have fallen sharply. Fixed mortgage rates have also come down but more moderately. I expect to start easing monetary policy in the spring, taking the overnight rate down by roughly 100 bps by yearend 2024. Housing activity will strengthen in 2024 and 2025, although the economy will be burdened by a substantial rise in monthly mortgage payments as many renewals or refinancing rise, peaking in 2026.

Source: Dr. Sherry Cooper, Chief Economist, Dominion Lending Centres