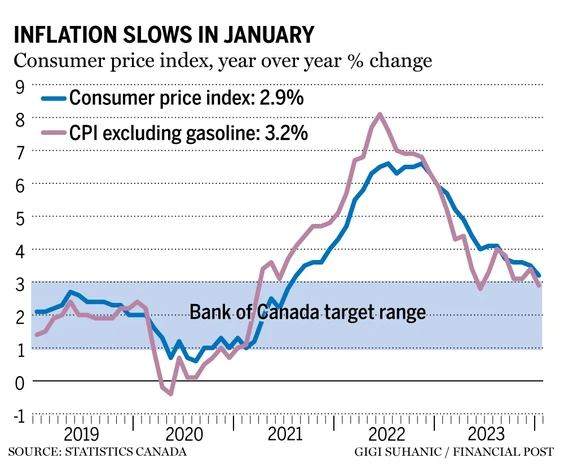

The Consumer Price Index (CPI) rose 2.9% year-over-year in January, down sharply from December’s 3.4% reading. The most significant contributor to the deceleration was a 4% decline in y/y gasoline prices, compared to a 1.4% rise the month before (see chart below). Excluding gasoline, headline CPI slowed to 3.2% y/y, down from 3.5% in December.

Headline inflation of 2.9% marks the first time since June that inflation has moved into the Bank of Canada 1%-to-3% target band and only the second time to breach that band since March 2021.

Grocery price inflation also decelerated broadly in January to 3.4% y/y, down from 4.7% in December. Lower prices for airfares and travel tours also contributed to the headline deceleration. Prices for clothing and footwear were 1.3% lower than levels from a year ago, potentially reflecting the discounting of winter clothing after a milder-than-usual winter in much of the country.

The shelter component of inflation remains by far the largest contributor to annual inflation. The effect of past central bank rate hikes feeds into the CPI with a lag. The y/y growth in mortgage interest costs edged lower in January but still posted a 27.4% rise and accounted for about a quarter of the total annual inflation. Inflation, excluding mortgage costs, is now at 2.0%. Home rent prices continue to rise, but another component under shelter – homeowners’ replacement costs inched lower on slower house price growth.

On a monthly basis, the CPI was unchanged in January, following a 0.3% decline in December. On a seasonally adjusted monthly basis, the CPI fell 0.1% in January, the first decline since May 2020.

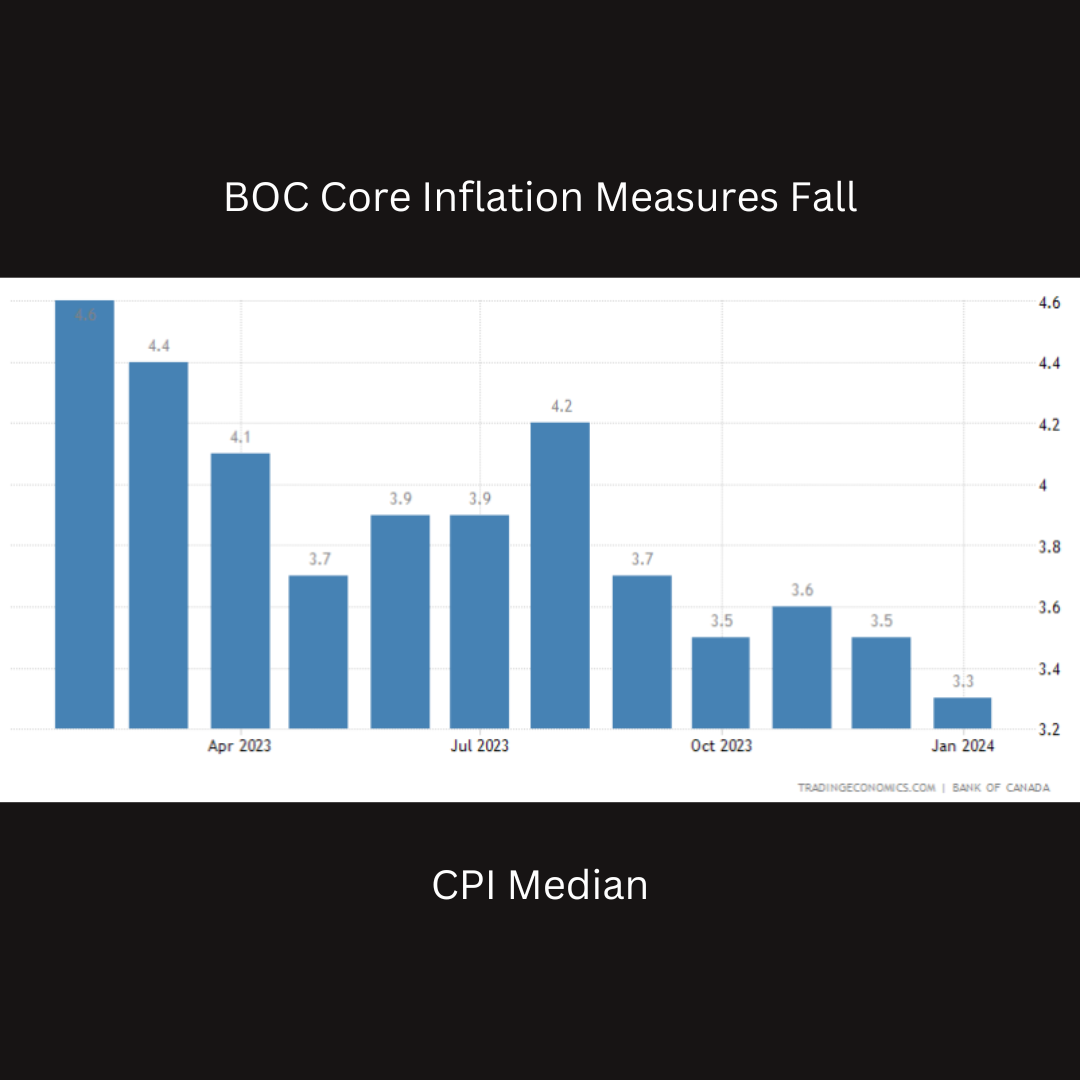

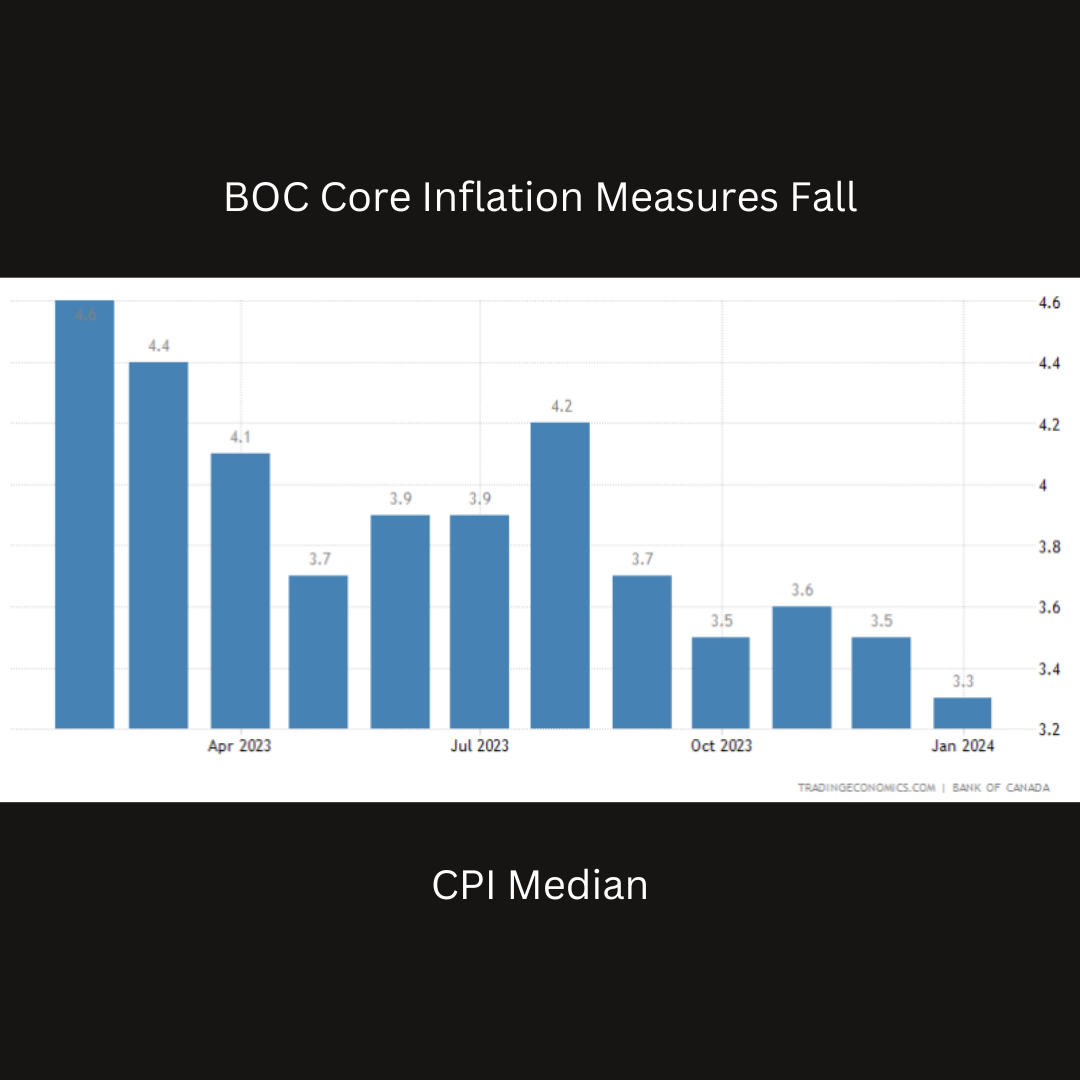

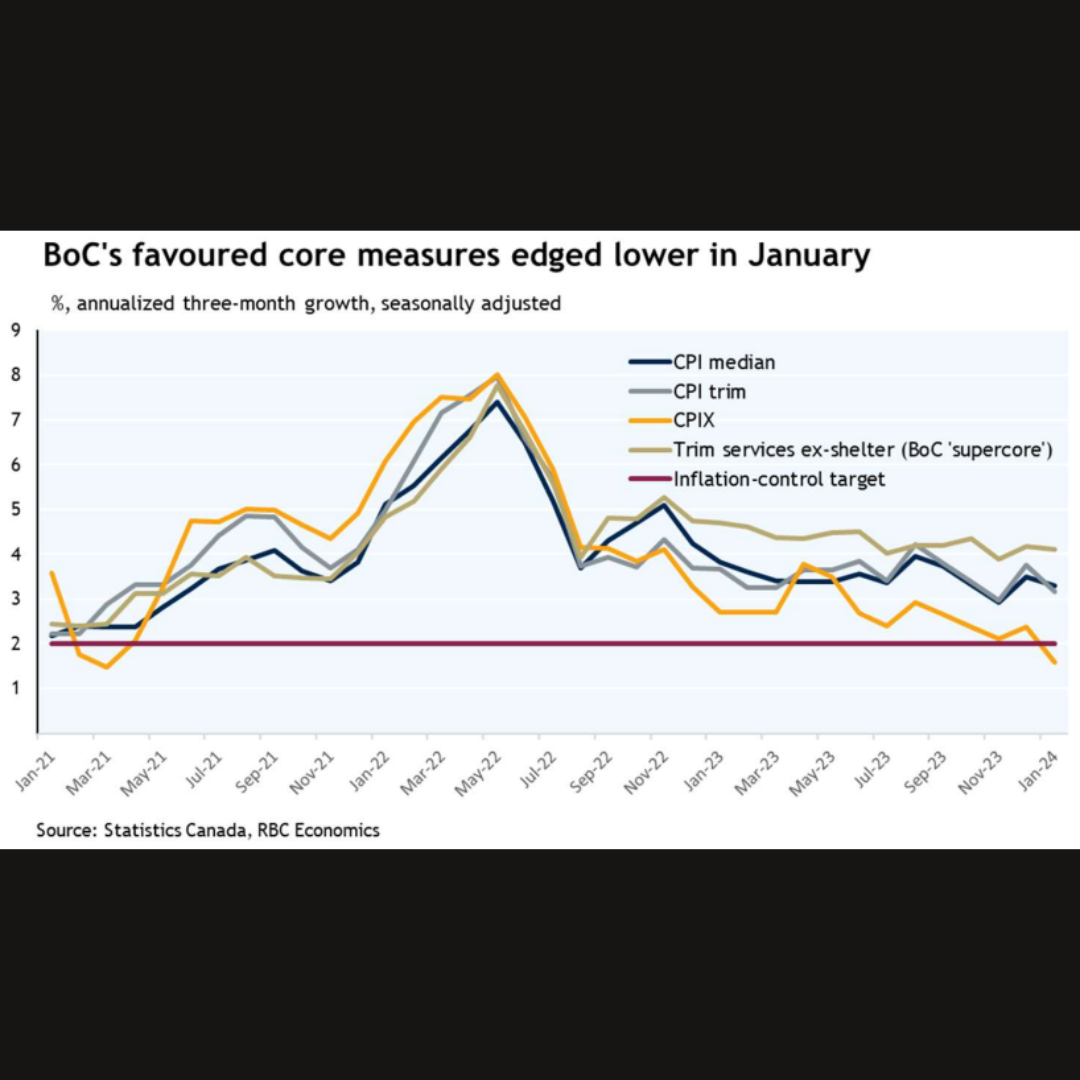

The Bank of Canada’s preferred core inflation measures, the trim and median core rates, exclude the more volatile price movements to assess the level of underlying inflation. The CPI trim slowed three ticks to 3.4%, and the median declined two ticks to 3.3% from year-ago levels, as shown in the chart below.

Notably, the share of the CPI basket of goods and services growing at more than 5% has declined from the peak of 68% in May 2022 to 28% in January 2024.

Bottom Line

The next meeting of the Bank of Canada Governing Council is on March 6. While January’s inflation report was better than expected and shows that the breadth of inflation is narrowing, it is still well above the level consistent with the 2% inflation target.

Shelter inflation will remain sticky as higher mortgage rates over the course of last year filter into the index and the acute housing shortage boosts rents.

The Bank of Canada will remain cautious in the face of still-high wage gains and core inflation measures above 3%. I hold to my view that the Bank will begin cutting rates in June.

Source: Dr. Sherry Cooper, Chief Economist, Dominion Lending Centres