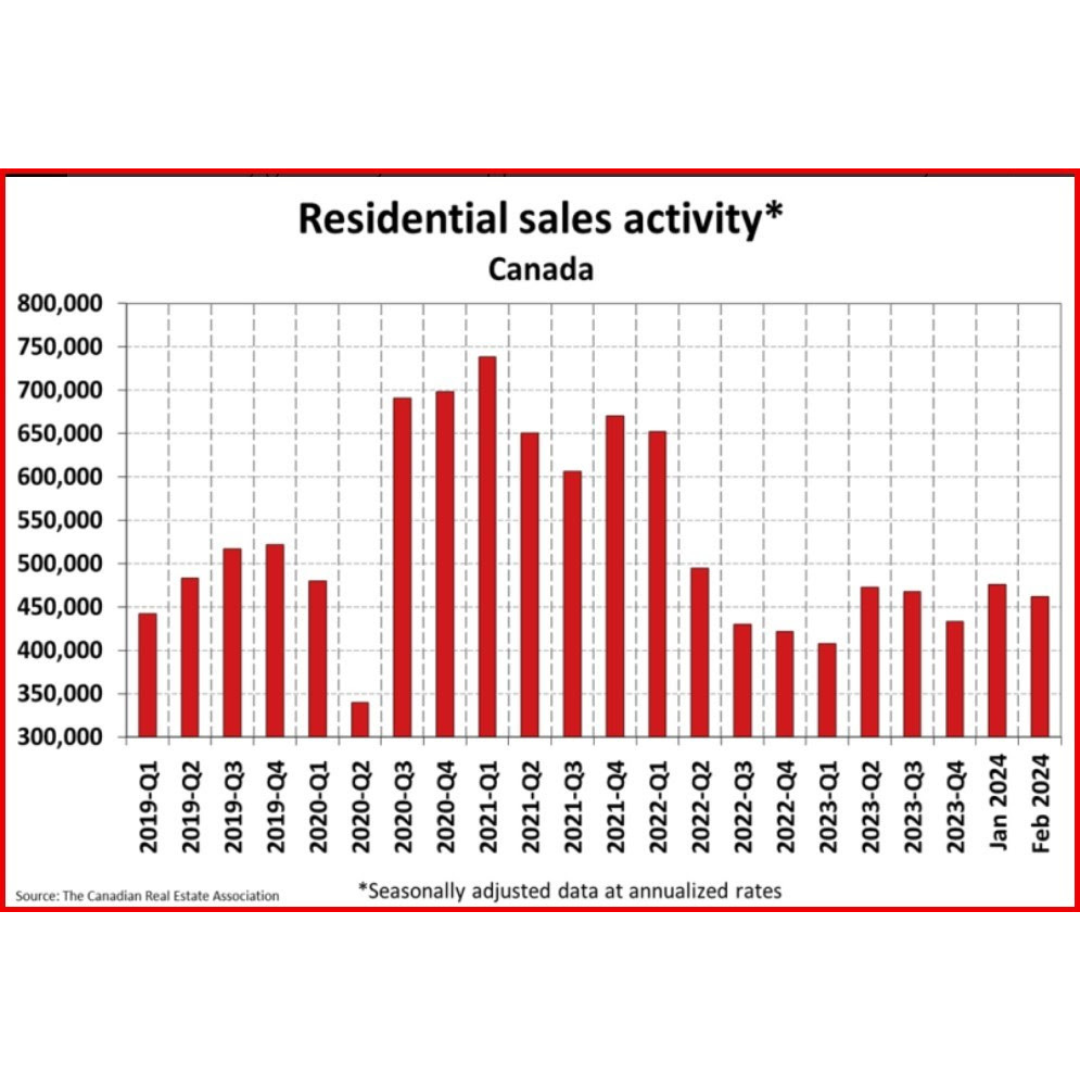

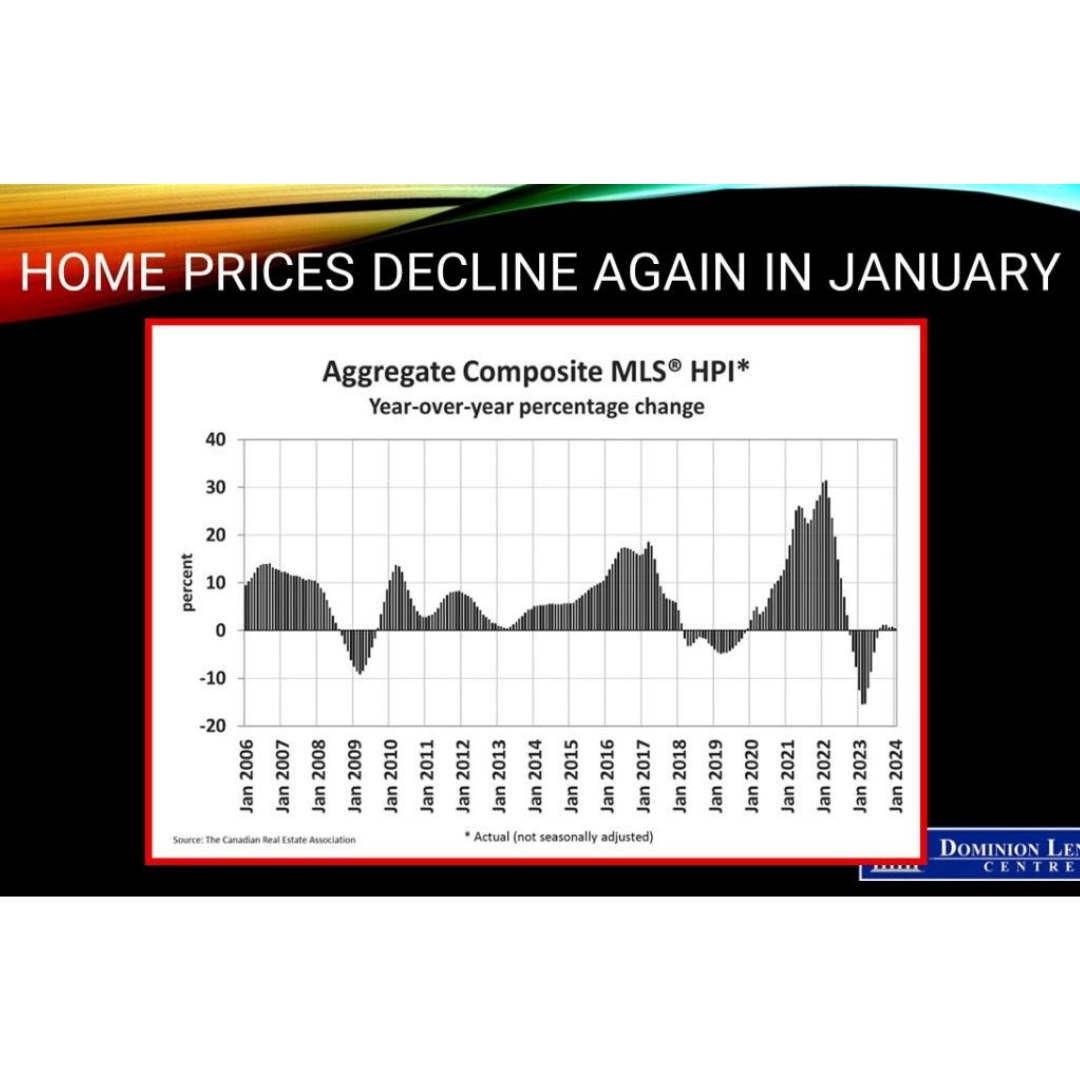

The Canadian Real Estate Association announced today that national home sales dipped 3.1% m/m in February while home prices were flat, ending a five-month price decline that began last fall.

It was noteworthy that prices remained unchanged from January to February, given that they dropped 1.3 from December to January. The MLS Home Price Index tends to be relatively stable, so a shift in pricing behaviour this large is quite unusual. It has happened only three other times in the past two decades. All three times were in the past four years when demand was poised to rise sharply: May 2020, right after the initial COVID slump; January 2022, before interest rates were increased; and April 2023, when people thought the Bank of Canada would continue to pause. The rebound in home sales in 2023 led the central bank to hike interest rates two more times.

There is significant pent-up demand for housing owing to strong population growth and first-time homebuyers’ fears that prices will rise sharply once the Bank of Canada cuts interest rates.

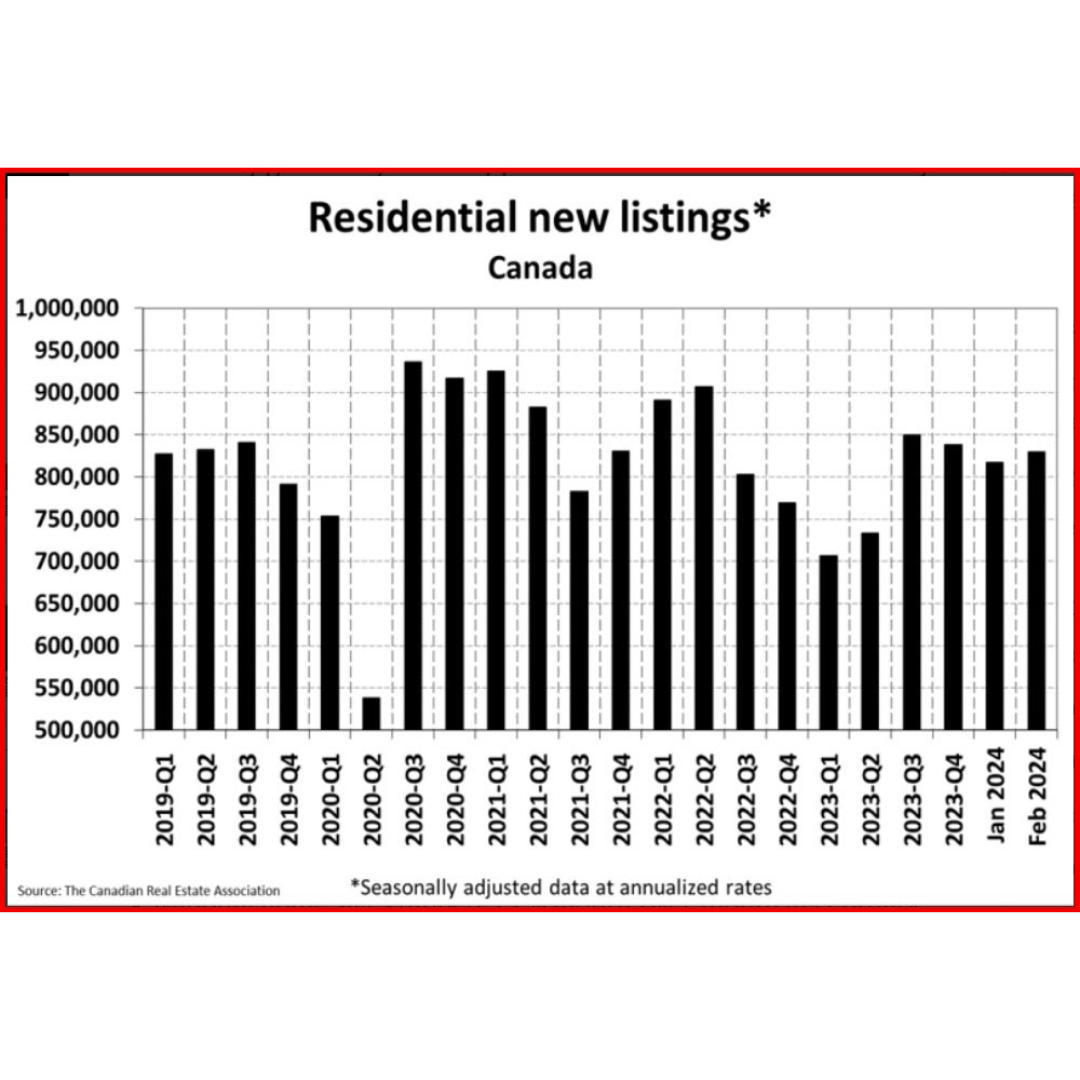

New Listings

The number of newly listed homes edged up 1.6% m/m in February. Depending on how many owners prepare to list their properties for sale this spring, gains may rise in the months ahead.

“After two years of mostly quiet resale housing activity, there’s a feeling that things are about to pick up,” said Larry Cerqua, Chair of CREA. “At this point, it’s hard to know whether buyers are going to wait for a signal from the Bank of Canada or whether they’re just waiting for the spring listings to hit the market.

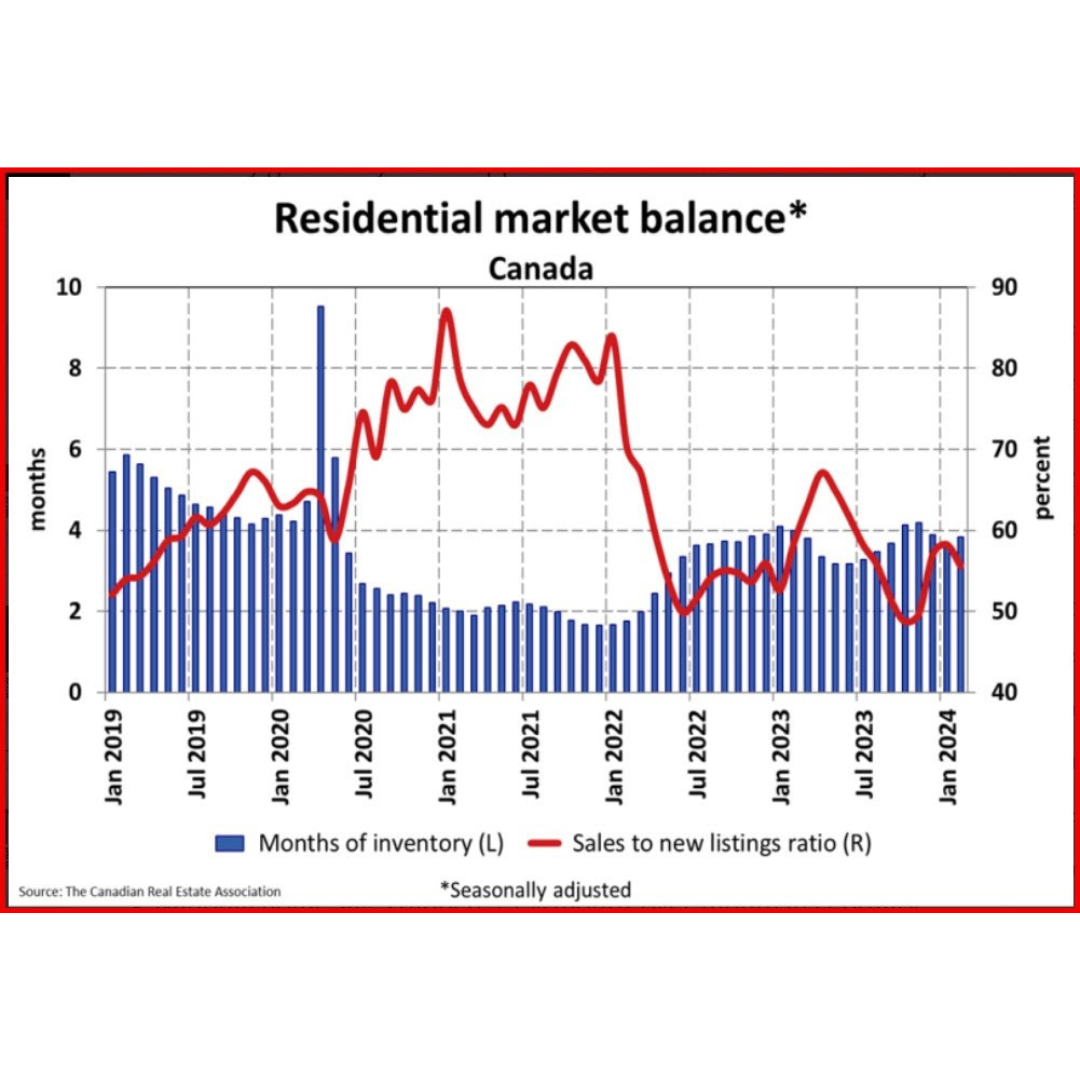

With sales edging down and new listings inching up in February, the national sales-to-new listings ratio eased a bit to 55.6%. The long-term average is 55%. A sales-to-new listings ratio between 45% and 65% is generally consistent with balanced housing market conditions, with readings above and below this range indicating sellers’ and buyers’ markets, respectively.

At the end of February 2024, there were 3.8 months of inventory nationwide, up slightly from 3.7 months at the end of January. The long-term average is about five months of inventory.

Bottom Line

Bottom Line

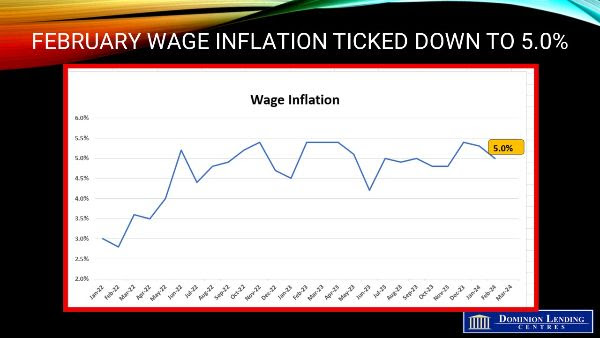

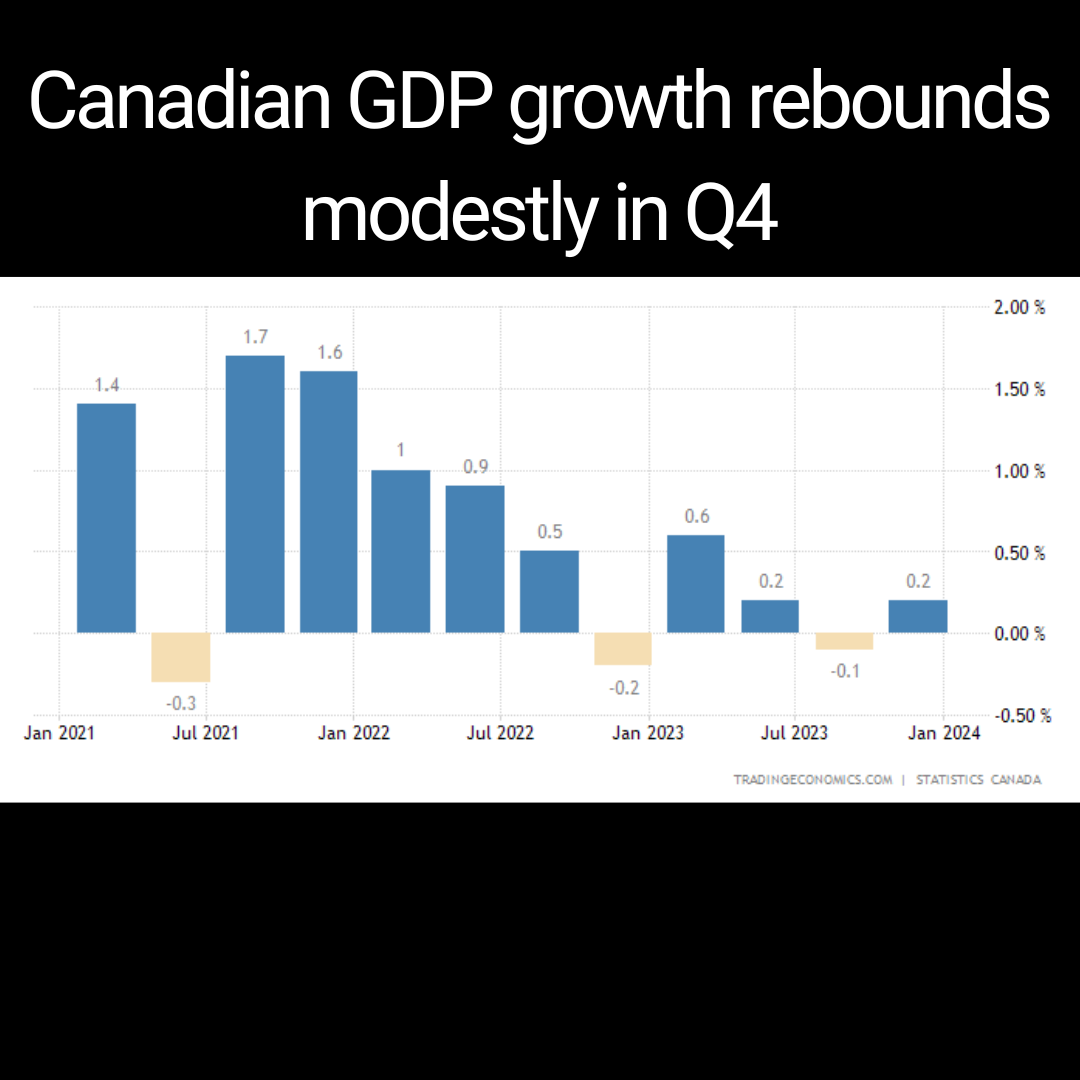

With pent-up demand for housing rising with every rent increase, the spring housing season is likely to be robust, even before the central bank cuts interest rates. We believe the BoC will begin reducing the policy rate in June. Tomorrow, we will get the CPI data for February. The US CPI data for February, released last week, were disappointing as gasoline prices increased headline inflation and core measures remained well above 3%.

Source: Dr. Sherry Cooper, Chief Economist, Dominion Lending Centres