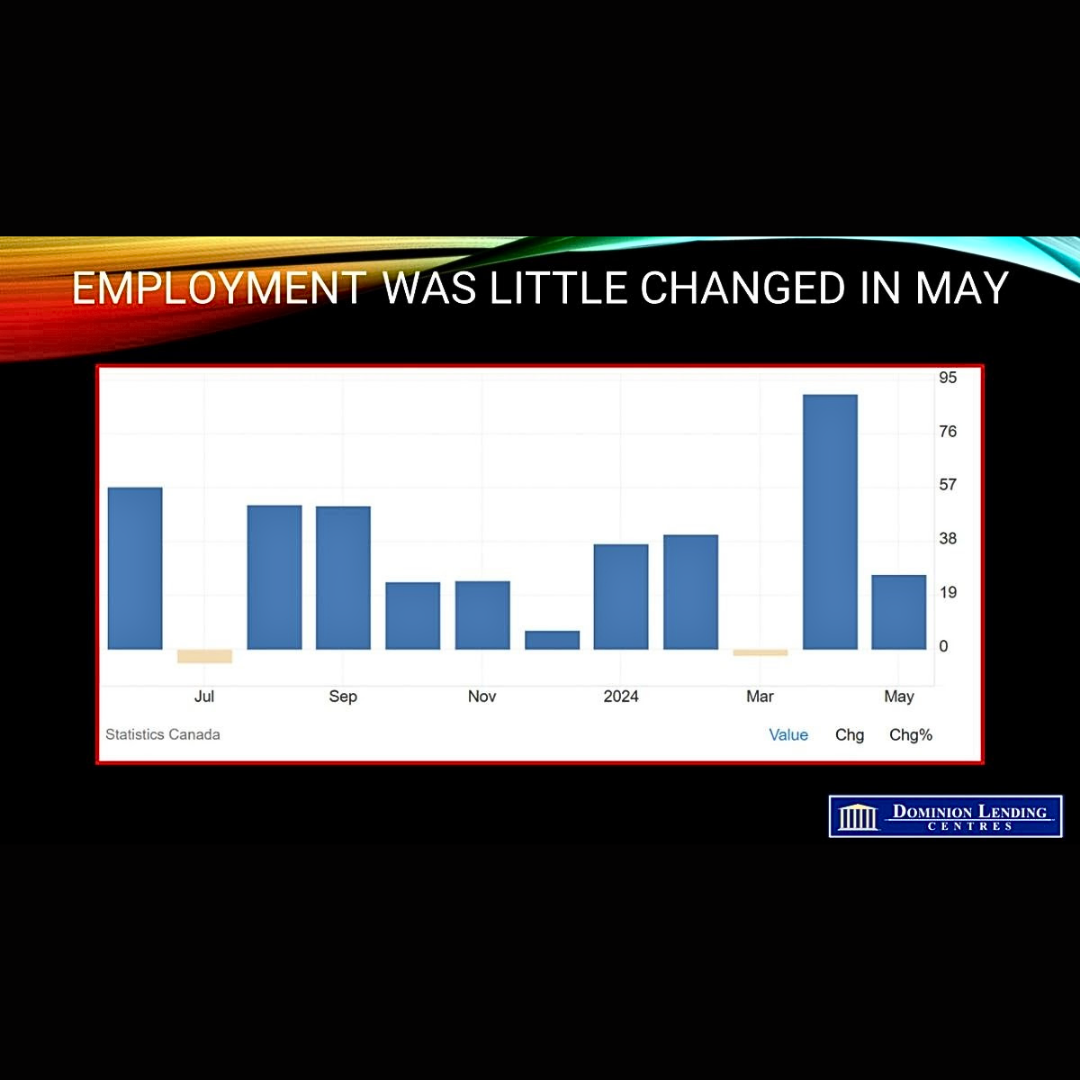

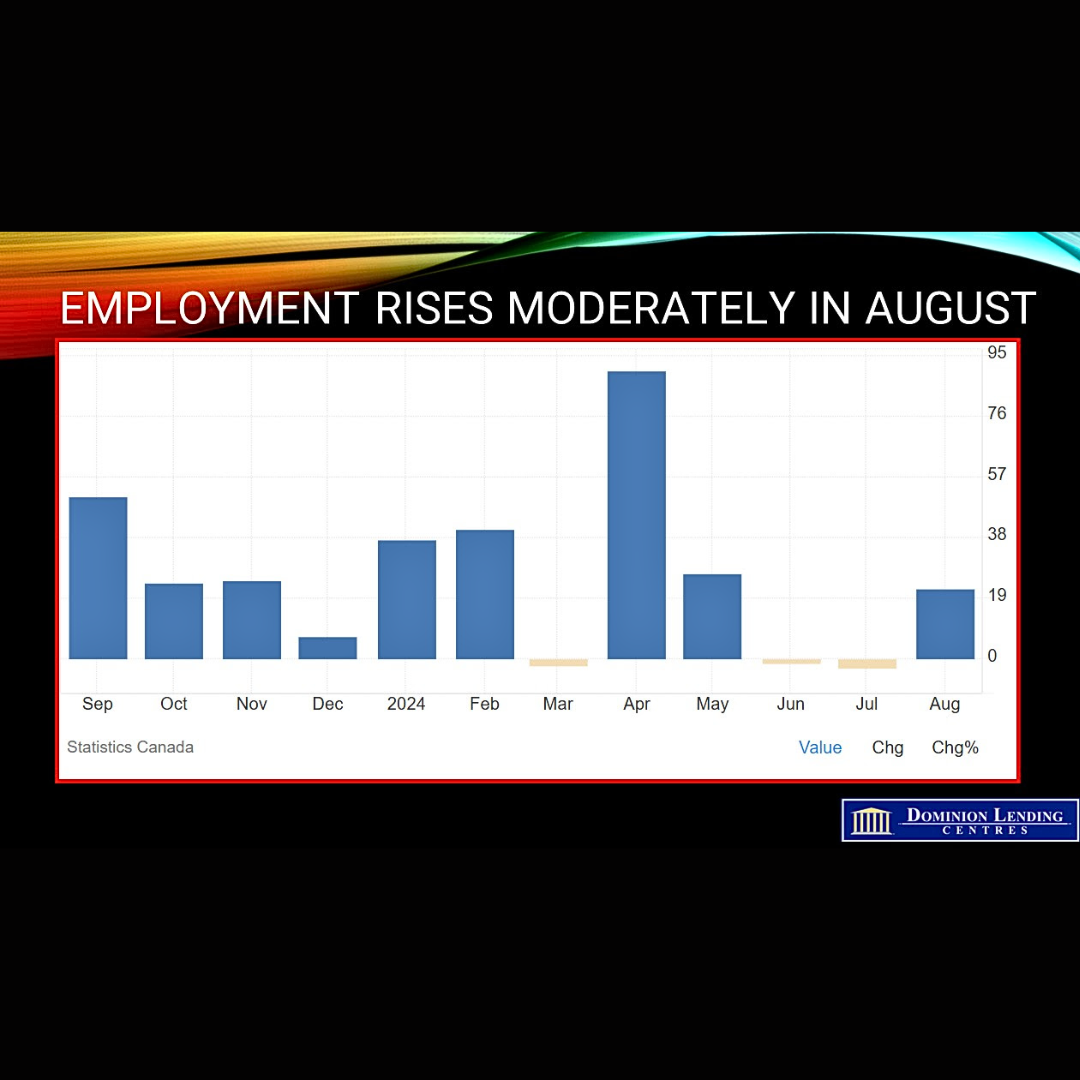

Statistics Canada released August employment data today, showing continued growth in excess supply in labour markets nationwide. Employment changed little last month, up 22,100. The employment rate—the proportion of the population aged 15 and older who are employed—decreased a tick to 60.8%, marking the fourth consecutive monthly decline and the 10th decline in the past 11 months. On a year-over-year basis, the employment rate was down 1.2 percentage points in August, as employment growth (+1.6%) was outpaced by growth in the working-age population (+3.5%).

Full-time jobs declined by 44,000 while part-time work increased by 66,000. This was the fourth straight month of very modest employment gains.

The Bank of Canada expressed mounting concern about the rising output gap–the difference between economic growth at full employment and the current underemployment growth of less than 2%.

The number of private sector employees rose by 38,000 (+0.3%) in August, mainly offsetting a similar-sized decrease in the previous month (-42,000; -0.3%). The increase in private-sector employment in August was the first since April. Public sector employment and self-employment both changed little in August.

Year-over-year employment growth was concentrated among core-aged (aged 25 to 54) men and women as youth unemployment surged. Young immigrants have been hardest hit.

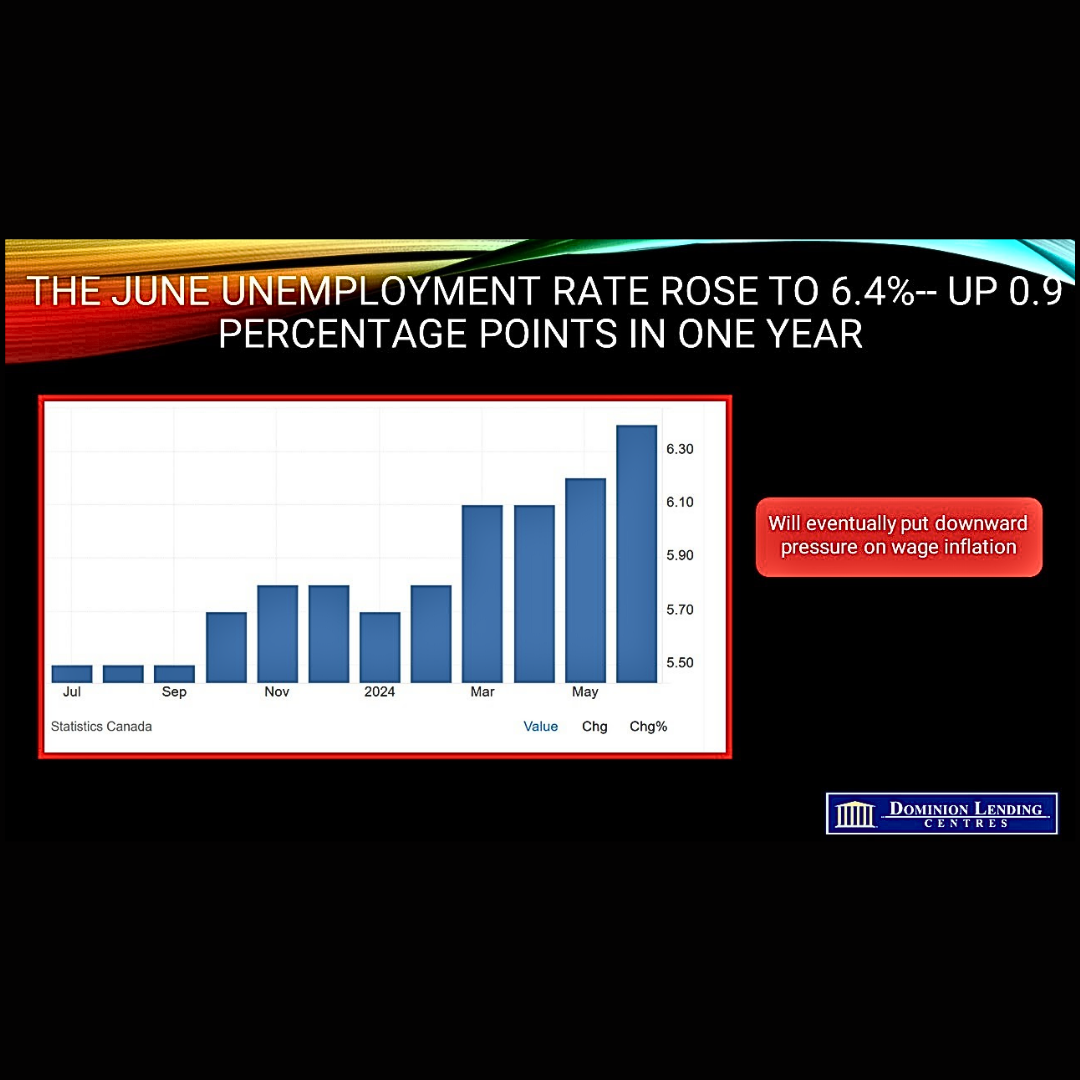

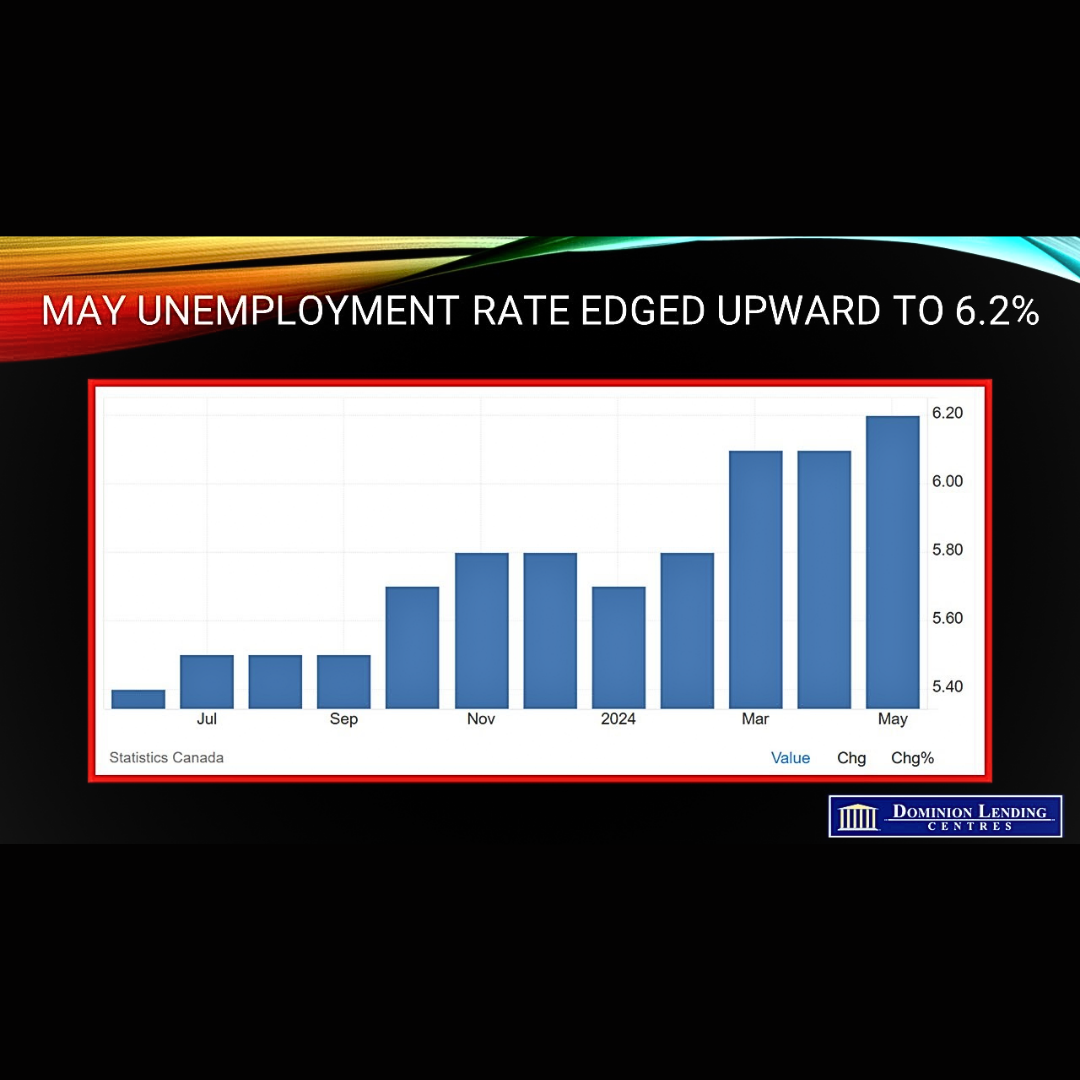

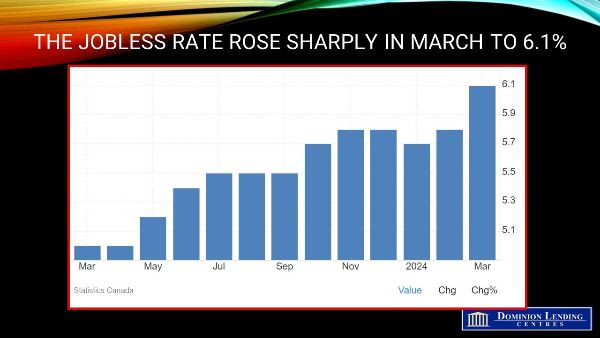

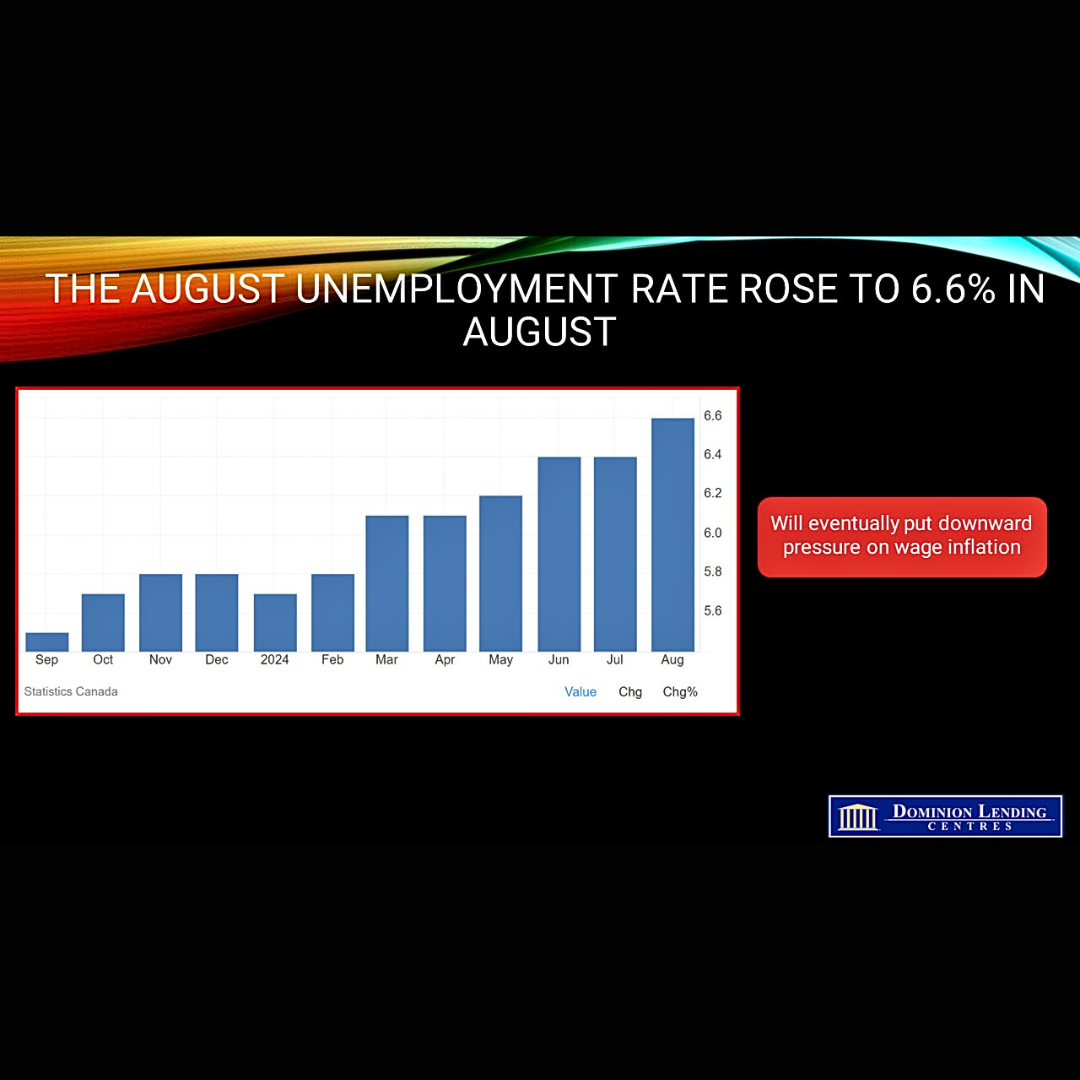

The unemployment rate rose 0.2 percentage points to 6.6% in August after holding steady in July. It was the highest since May 2017, outside of 2020 and 2021, during the COVID-19 pandemic. The unemployment rate has generally increased since April 2023, rising 1.5 percentage points.

In August 2024, 1.5 million people were unemployed, an increase of 60,000 (+4.3%) from July and 272,000 (+22.9%) from August 2023.

Among those unemployed in July, 16.7% had transitioned to employment in August (not seasonally adjusted). This was lower than the corresponding proportion in August 2023 (23.2%), indicating that unemployed people may face more difficulties finding work.

In August, the unemployment rate rose for men aged 25 to 54 years old (+0.4 percentage points to 5.7%) and for men aged 55 and older (+0.4 percentage points to 5.5%), while it was little changed for other major demographic groups.

Although the unemployment rate was up across all age groups year-over-year in August, the increase was most significant for youth (+3.2 percentage points to 14.5% in August). The rate was up for young men (+3.8 percentage points to 16.3%) and young women (+2.6 percentage points to 12.6%).

For core-aged people, the jobless rate was up 0.9 percentage points to 5.4% on a year-over-year basis in August. Increases for this age group were observed across all levels of educational attainment. On a year-over-year basis, the unemployment rate was up in August for core-aged people with a high school diploma or less (+1.5 percentage points to 8.2%), for those with some post-secondary education below a bachelor’s degree (+0.7 percentage points to 5.5%) as well as for those with a bachelor’s degree or a higher level of education (+0.9 percentage points to 6.2%) (not seasonally adjusted).

In August, employment rose by 27,000 (+1.7%) in educational services, the first increase since January. There were 75,000 (+5.1%) more people employed in this sector than 12 months earlier.

In August, health care and social assistance employment increased by 25,000 (+0.9%). In the 12 months to August, employment gains in health care and social assistance (+157,000; +5.8%) were the largest of any sector and accounted for nearly half (49.6%) of total net employment growth.

Year-over-year employment growth in health care and social assistance was recorded in the private sector (+94,000; +8.6%) and the public sector (+77,000; +6.1%). Self-employment in health care and social assistance changed little over the period (not seasonally adjusted).

Canada’s unemployment rate has risen from 5% at the start of last year.

The youth unemployment rate continued to surge in August, rising to 14.5%, the highest since 2012 outside the pandemic.

Bottom Line

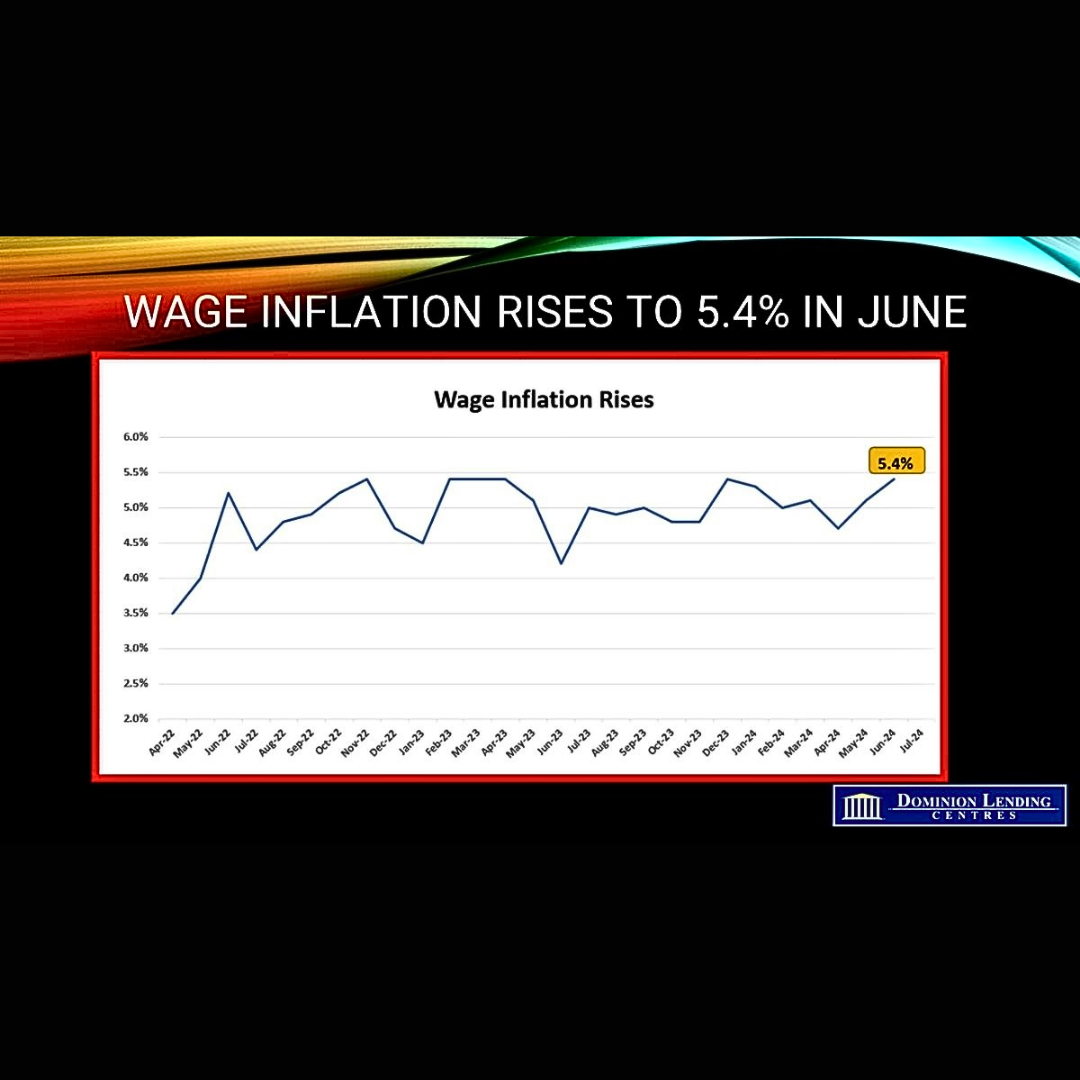

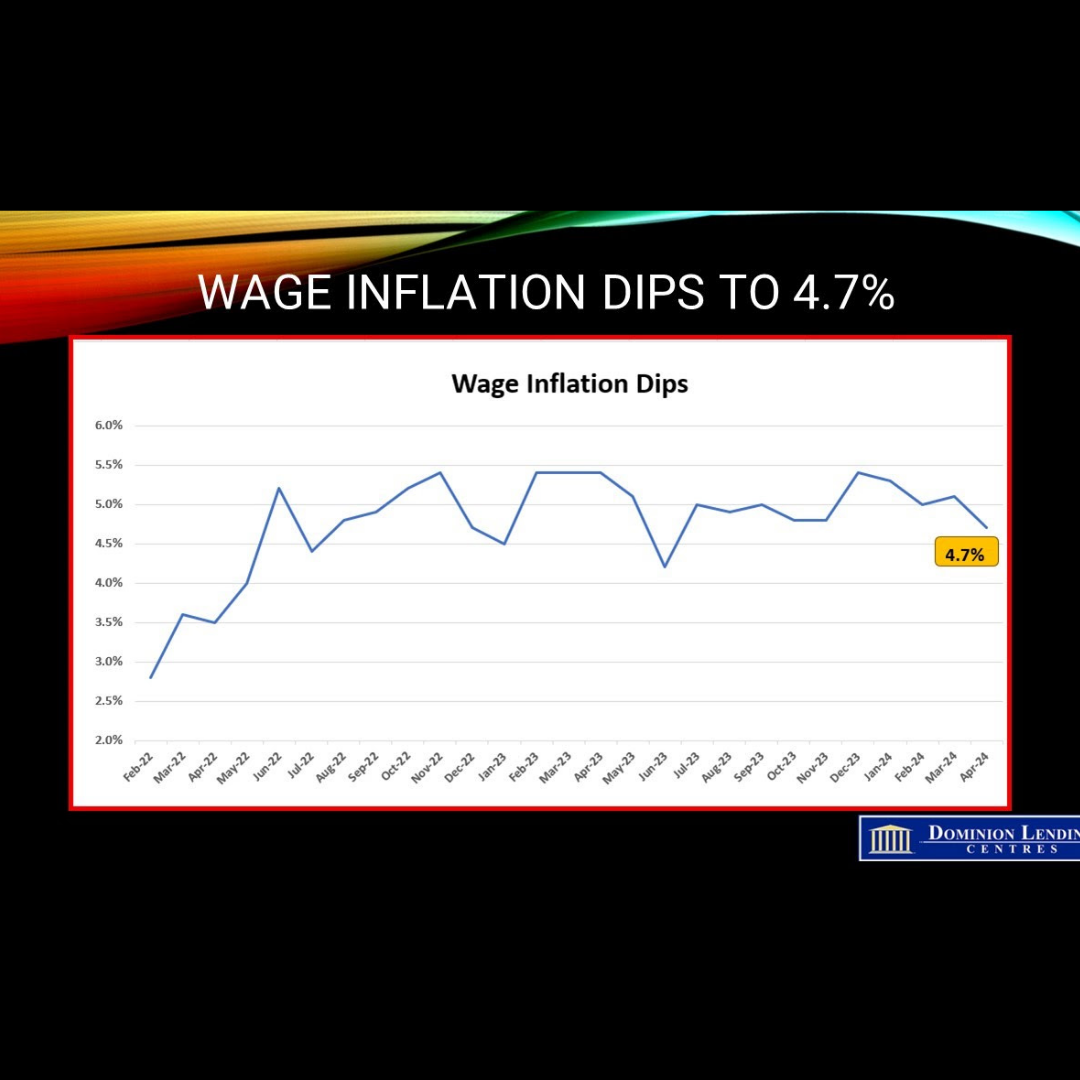

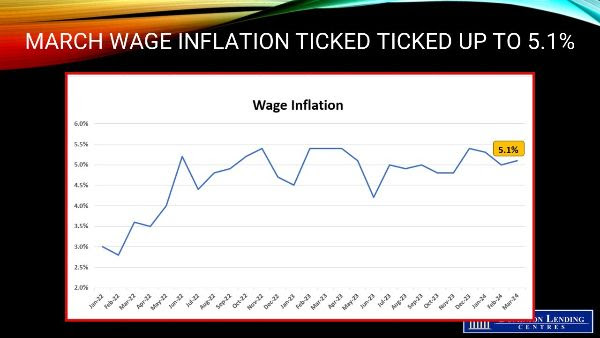

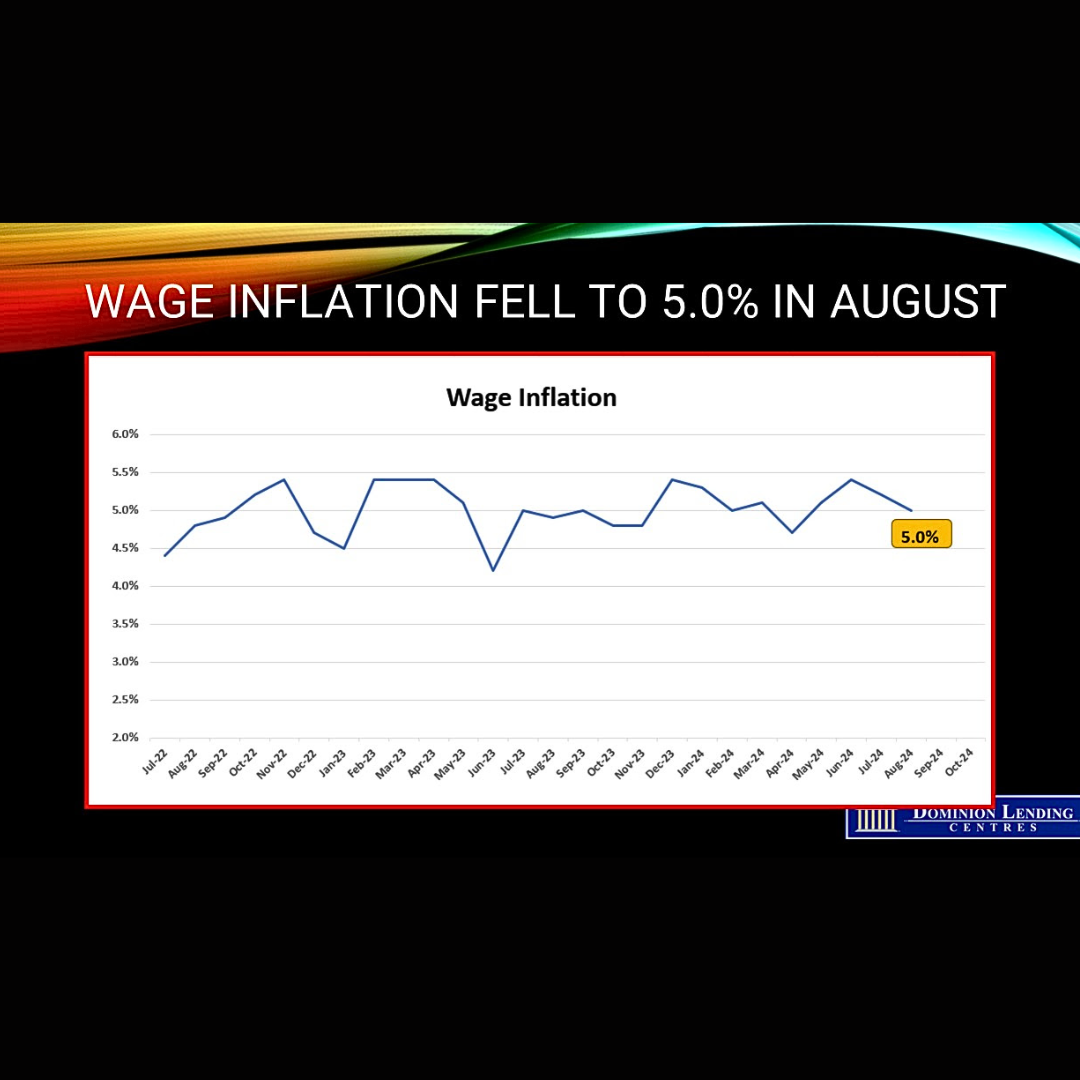

The data point to deteriorating labour demand in an economy that consistently fails to add jobs at the pace of population growth. And while there’s little evidence of widespread layoffs, the continued weakness is likely to add to disinflationary pressures, allowing the Bank of Canada to keep lowering borrowing costs at a gradual pace.

Still, the unexpected jump in the jobless rate will further fuel debate about deeper interest rate cuts. Traders in overnight index swaps boosted bets that the Bank of Canada would cut by 50 basis points at its Oct. 23 meeting. They now put those odds at around 40%, compared with about 30% the day before.

Policymakers led by Governor Tiff Macklem reduced the policy rate by 25 basis points for a third straight time on Wednesday. Officials say they’re increasingly focused on downside worries and guard against the risk that growth slows too much. Speaking to reporters, Macklem said the Governing council had discussed a scenario wherein the economy and inflation were weak enough to require a more significant than a quarter-point reduction in borrowing costs. Policymakers also reiterated they’re concerned about undershooting their 2% inflation target. “We need to increasingly guard against the risk that the economy is too weak and inflation falls too much,” the governor said.

This is the first of two job reports before the October rate decision. A Bloomberg survey found that most economists expect the bank to cut by 25 basis points at the next four meetings, bringing the policy rate to 3% by mid-2025.

The Canadian data were released simultaneously with the highly anticipated nonfarm payrolls in the US, which rose by 142,000 following downward revisions to the prior two months. Economists surveyed by Bloomberg were expecting an increase of 165,000. Treasury yields fell as markets weighed whether the weaker job gains would prompt a larger than quarter percentage point cut from the Federal Reserve when they meet again on September 18.

Source: Dr. Sherry Cooper, Chief Economist, Dominion Lending Centres