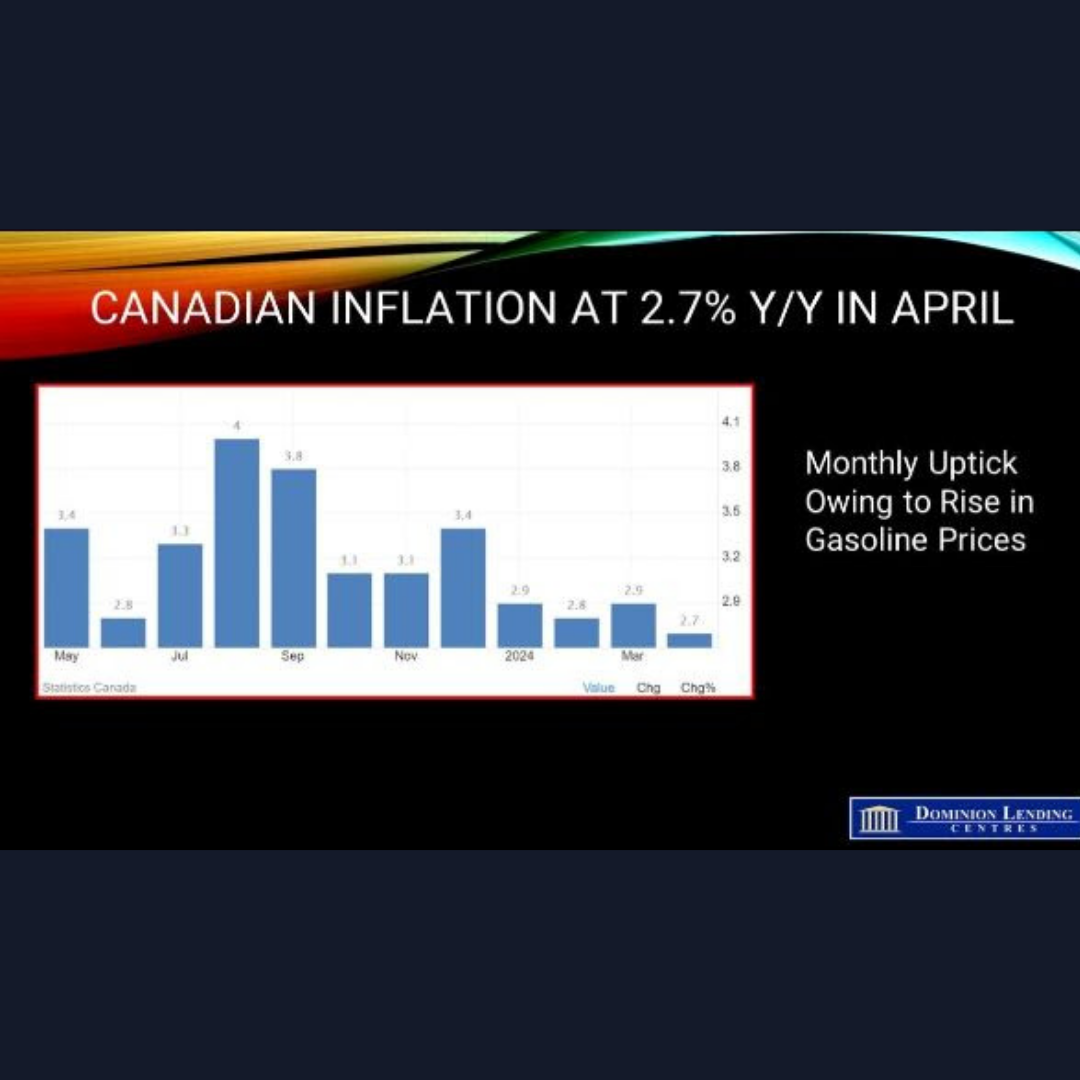

Canadian Inflation Eased Again in April, Raising the Chances of a June Rate Cut

The Consumer Price Index (CPI) rose 2.7% year-over-year (y/y) in April, down from 2.9% in March. This marks the fourth consecutive decline in core inflation. Food prices, services, and durable goods led to the broad-based deceleration in the headline CPI.

The deceleration in the CPI was moderated by gasoline prices, which rose faster in April (+6.1%) than in March (+4.5%). Excluding gasoline, the all-items CPI slowed to a 2.5% year-over-year increase, down from a 2.8% gain in March.

The CPI rose 0.5% m/m in April, mainly due to gasoline prices. On a seasonally adjusted monthly basis, it rose 0.2%.

While prices for food purchased from stores continue to increase, the index grew slower year over year in April (+1.4%) compared with March (+1.9%). Price growth for food purchased from restaurants also eased yearly, rising 4.3% in April 2024, following a 5.1% increase in March.

According to Bloomberg calculations, the three-month moving average of the rate rose to an annualized pace of 1.64% from 1.35% in March. That’s the first gain since December.

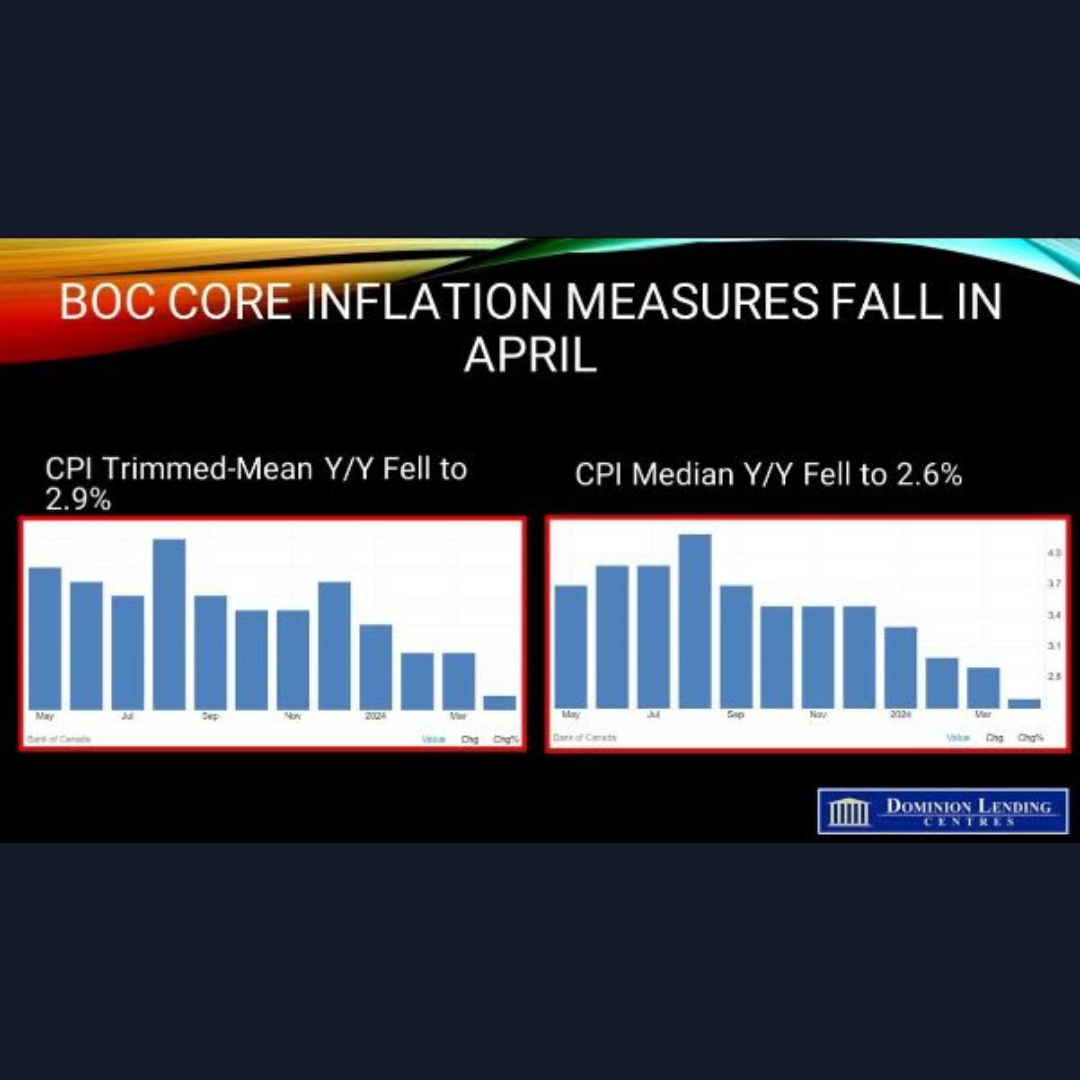

The Bank of Canada’s preferred core inflation measures, the trim and median core rates, exclude the more volatile price movements to assess the level of underlying inflation. The CPI trim slowed to 2.9% y/y in April, and the median declined to 2.6% from year-ago levels, as shown in the chart below. Rising rent and mortgage interest costs account for a disproportionate share of price growth, with shelter costs up 6.4% year-over-year. Growth in mortgage interest costs slightly decreased in April but remained 24.5% higher than a year ago.

The breadth of inflationary pressures narrowed again in April, with the proportion of the CPI basket experiencing growth exceeding 3%, decreasing to 34% from 38% in March.

Bottom Line

April’s inflation readings largely met expectations but with underlying details (including further slowing in the BoC’s preferred ‘core’ measures) pointing to a further reduction in inflationary pressures. The Bank of Canada is as concerned about where inflation will go in the future as where it is right now. Still, Canada’s persistently softer economic backdrop (declining per-capita GDP and rising unemployment rate) increases the odds that price growth will continue to slow. The case for interest rate cuts from the Bank of Canada continues to build. The central bank has every reason to cut rates at their next meeting on June 5. Still, given the BoC’s extreme caution, we must consider the possibility that they will wait until the July meeting to take action, and only if inflation continues to recede.

Source: Dr. Sherry Cooper, Chief Economist, Dominion Lending Centres