Federal Budget Targets Rich Canadians For New Spending

The budget focuses on helping Millennial and Gen Z voters experiencing rising housing costs and other inflationary pressures. The government has set fiscal anchors, such as keeping the deficit below 1% of GDP starting in 2027.

The Canadian federal government released its 2023 budget over a year ago, promising to conduct a strategic spending review to find $15.4 billion in savings. The savings were supposed to achieve fiscal credibility by offsetting the $43 billion in new government spending. However, nearly a year after its announcement, the spending review found only $9 billion in savings, while the government piles on new spending measures in this year’s budget.

The fiscal path is mostly the same as in the 2023 Fall Economic Statement, but only after revenue gains from a resilient economy and further tax increases triggered even bigger spending initiatives.

Government spending is expected to be $480 billion in the next fiscal year, including $54 billion in payments on the country’s debt.

Finance Minister Freeland also announced a soak-the-rich tax scheme, levelling higher taxes on capital gains for people who make more than $250,000 selling stock or property other than a person’s primary residence.

Currently, 50% of capital gains profits are taxed, compared to 100% of a person’s employment income. That will remain the case for the first $250,000 of capital gains income, but it will rise to 66.6% on income above that level. So, the proposal is to reduce the tax-exempt amount to one-third for capital gains exceeding $250,000.

The lower exemption would also apply to businesses for all capital gains, not just those over $250,000. The additional capital gains taxes are expected to rake $19.4 billion into the government’s coffers over the next five years, which is no small measure. This will reduce business capital spending, already at rock-bottom lows, rendering the Canadian productivity problem even more egregious. Higher capital gains taxes also disincentivize investment in residential rental real estate.

The FY24/25 budget deficit is estimated at $39.8 billion (1.3% of GDP), with the numbers massaged just enough to meet the various ‘fiscal guideposts’. Any path to a balanced budget continues to be absent.

Bank of Canada Governor Tiff Macklem has said provincial government spending is already making it harder to lower inflation. Running federal deficits — on top of large provincial deficits in Quebec, Ontario and British Columbia — is irresponsible. The government had previously set fiscal anchors, like keeping the deficit below 1% of GDP starting in 2027.

Philip Cross of the National Post writes, ”deficit spending when inflation is above target violates the 1991 accord between the Government of Canada and the Bank of Canada, which “jointly set forth targets for reducing inflation” and requires both parties to collaborate to achieve that goal.”

Cumulatively, the total deficit between FY23/24 and FY28/29 is now running $10 billion larger than in the Fall Economic Statement.

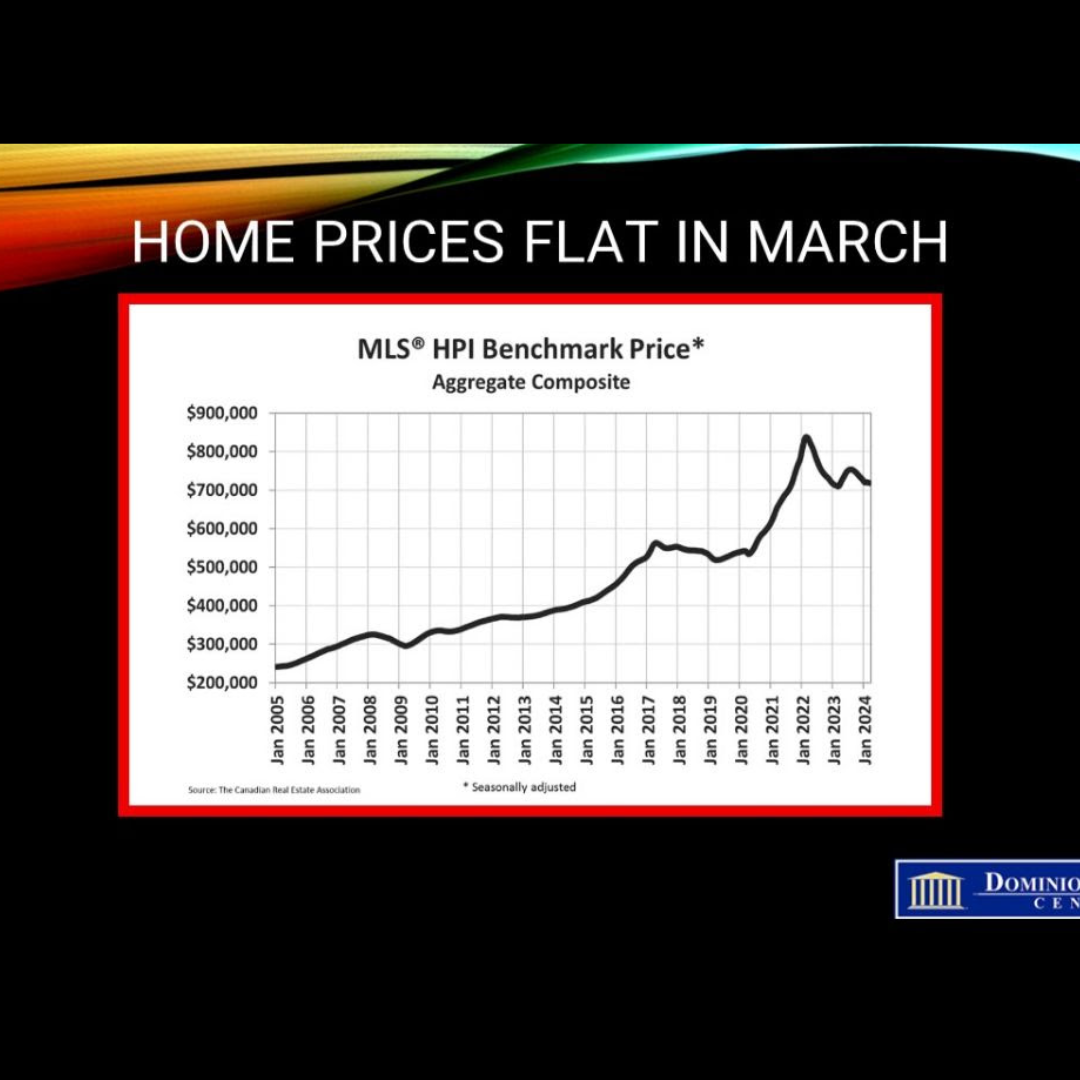

The Housing Plan

The housing measures were pre-announced, and the market impact should be minimal. However, the higher capital gains inclusion rate will impact those planning to sell valuable properties with much lower cost bases. It will change the economics of real estate investment in rental properties, an area that needs to be more generously funded.

Some Other Housing Measures:

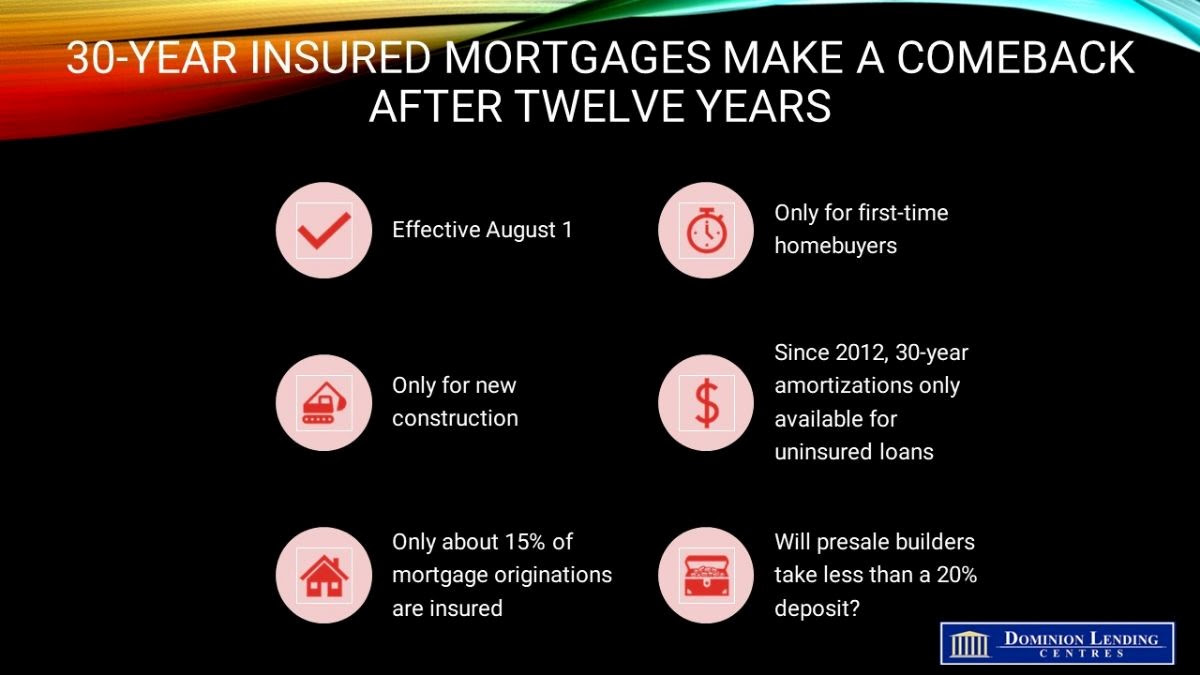

Allowing 30-year mortgage amortizations for first-time home buyers purchasing new builds. This measure zeroes in on a small subset of the market. In general, though, it stokes excess demand and ultimately does little to improve affordability once prices adjust. Also, limits on the size of insured mortgages mitigate its impact in our most expensive cities. Pre-construction sales usually require a 20% downpayment, which limits the use of insured mortgages, which account for only 15% of mortgage originations.

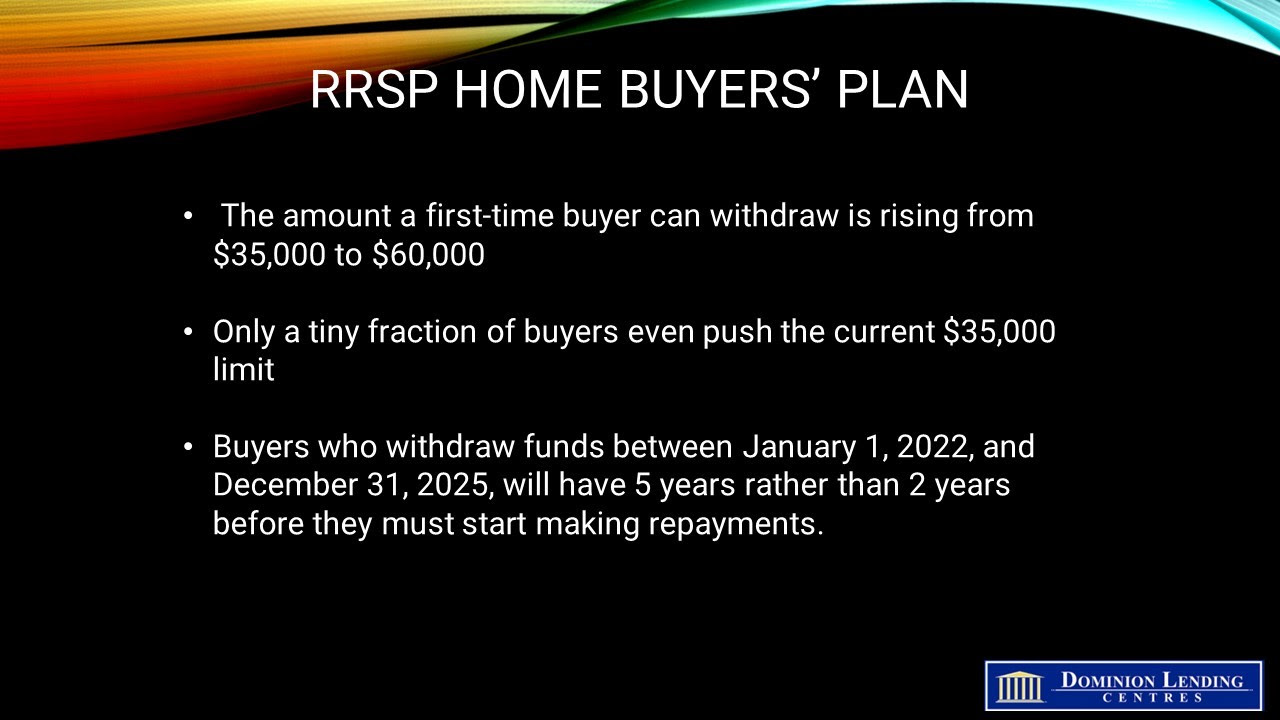

Increase the RRSP Home Buyers’ Plan limit from $35,000 to $60,000 and extend the three-year payback period.

Create a renters’ bills of rights and tenant protection fund. Some details here are curious, such as a national standard lease agreement (which is provincial jurisdiction). At any rate, the deck is stacked against landlords from bringing more quality rental supply to market—think taxes.

Accelerated capital cost allowances on the construction of new purpose-built rentals and removal of the HST on the construction of student rentals.

Increase the annual Canada Mortgage bond limit to $60 billion from $40 billion.

Top up the Housing Accelerator Fund to incentivize the removal of zoning barriers and tie transit funding to densification along transit corridors.

Bottom Line

This is a pre-election ‘tax and spend’ budget, which will do little to address the problems it claims to solve. It exacerbates other concerns, including insufficient business capital spending, low productivity growth, and insufficient investment in rental real estate.

Slowing the growth in nonpermanent immigration will, in time, do more to address the housing shortage than any of these measures.

Source: Dr. Sherry Cooper, Chief Economist, Dominion Lending Centres